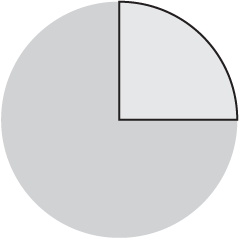

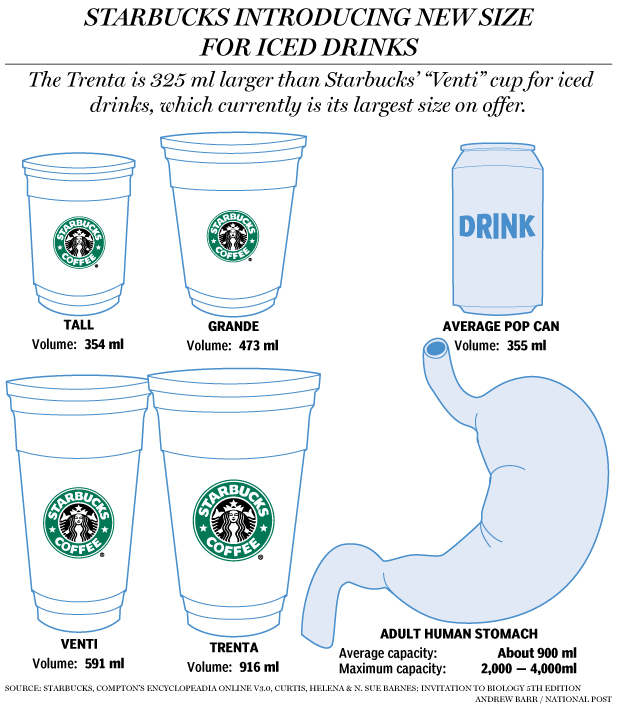

Starbucks recently announced their next size up from 591-milliliter Venti: the Trenta. It’s 916 milliliters, which happens to be slightly more than the average capacity of the human stomach, as illustrated by Andrew Barr for The National Post.

I don’t know why everyone’s getting their panties in a bundle though. If it’s too big for you, then don’t buy it. Besides, 7-Eleven has Starbucks beat with their line of Big Gulp drinks ranging from 0.59 to 1.9 liters.

I’m thirsty.

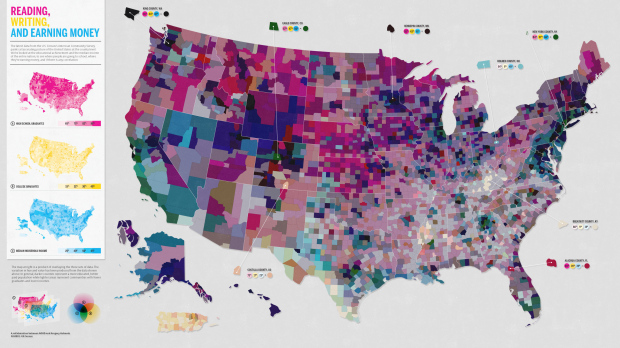

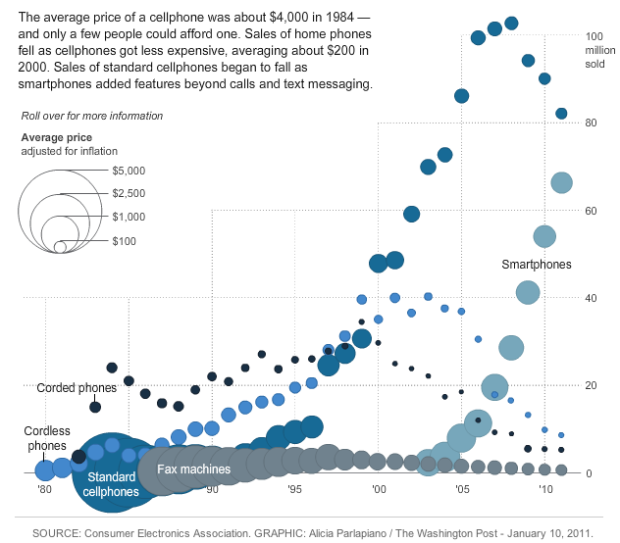

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)