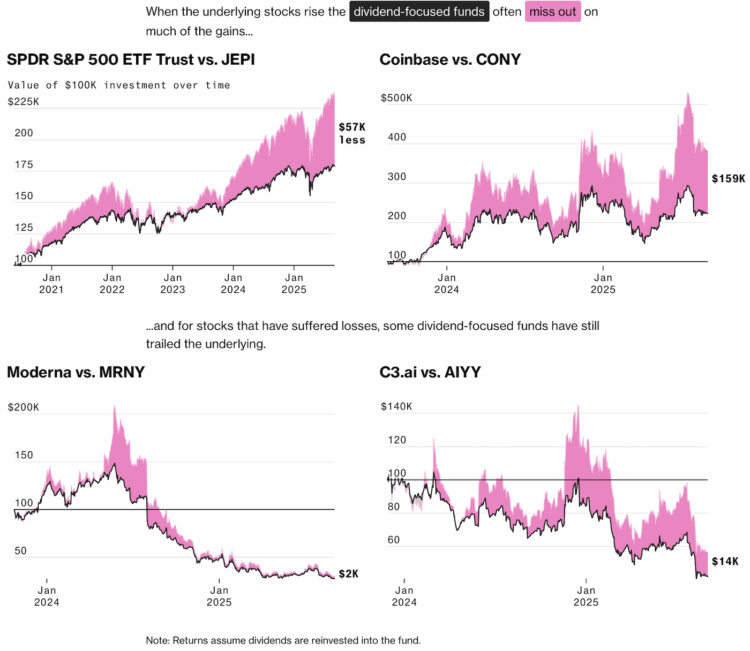

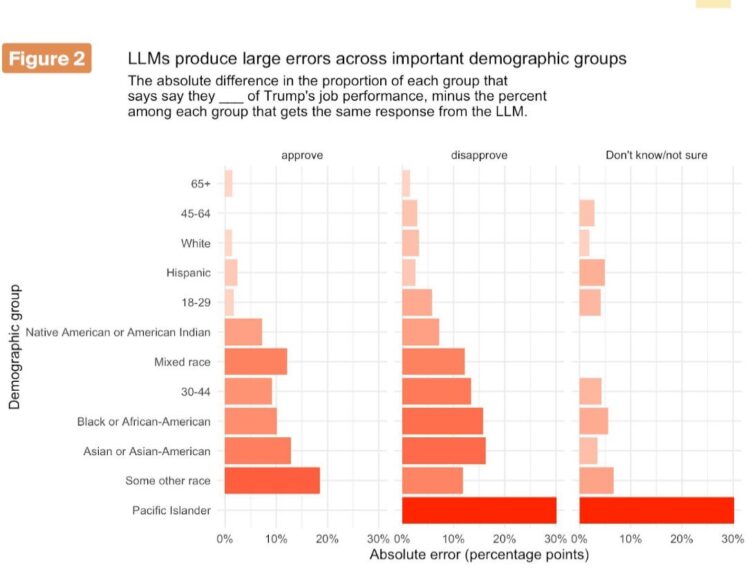

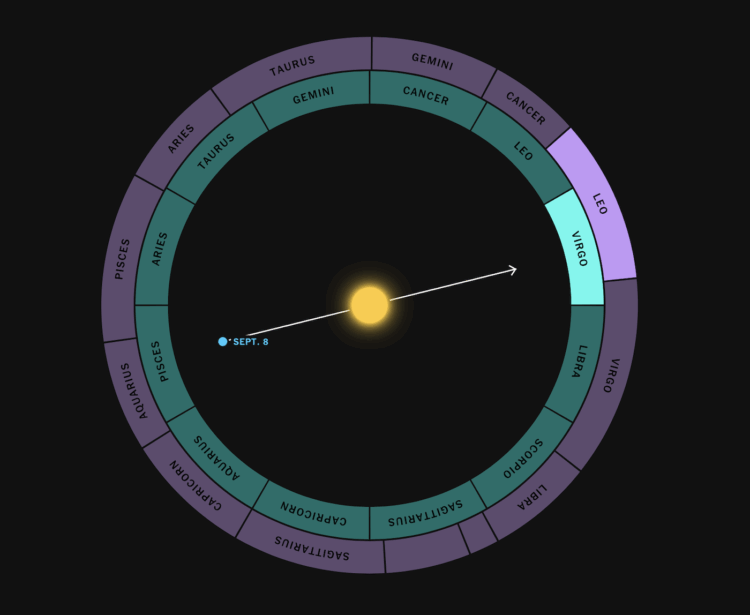

There is a growing trend among investors to put money in places with high dividends. They prefer money now over decades from now. However, the higher dividends come at a cost in the longer term. For Bloomberg, Denitsa Tsekova and Vildana Hajric, with graphics by Armand Emamdjomeh, discuss the trade-offs that make the money-now approach seem less favorable.

The current wave of interest is new enough — and many of the followers young enough — that it has been easy to ignore how the most popular funds have often lagged basic stock indexes and threaten to eat away at long-term returns. Samuel Hartzmark, a professor of finance at Boston College, has researched the issue for more than a decade and has found that investors tend to fall for the “free dividends fallacy,” treating them and capital gains as separate. A 2015 paper of his finds that investors prone to that bias have a preference for funds that report boosted dividends even if they don’t improve overall returns.

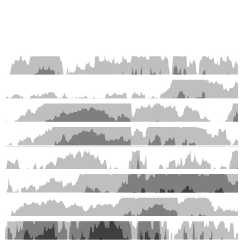

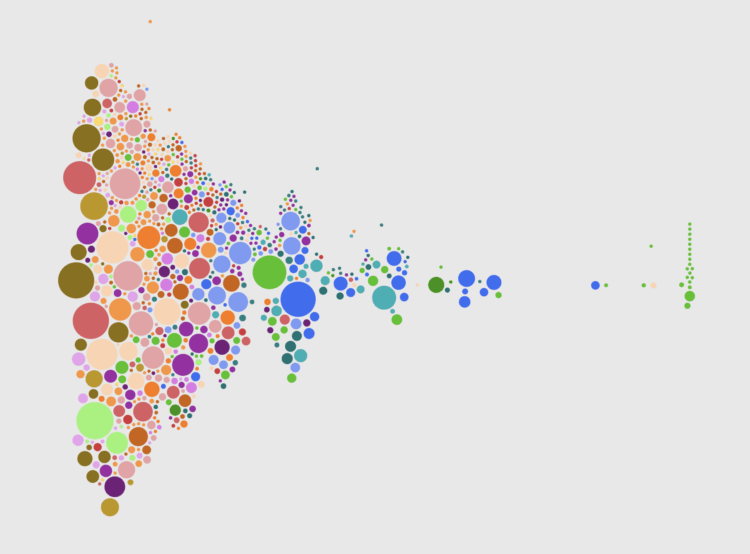

There is a scrolling chart at the beginning that compares returns with different strategies over time. At first, I wasn’t fond of a non-zero baseline on an area chart, but technically it’s a difference chart with a baseline that indicates the starting investment. I guess I’ll let it slide.

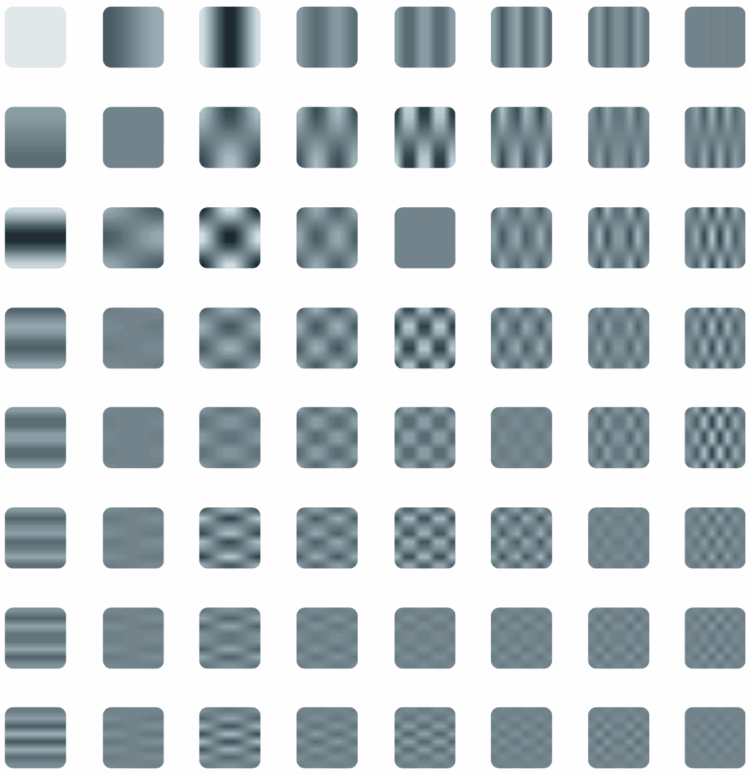

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)