Income Sources

Most people have a job and receive wages in return, but that starts to change when you get into the higher income groups. We turn to the 2021 American Community Survey (ACS) to see how income sources can vary.

Let’s say this square represents one hundred dollars:

Equals $100

If someone makes $10,000 in a year, we represent the year’s income with 100 squares (10,000 divided by 100).

Here’s the income for an aircraft technician in the ACS sample:

An Aircraft Technician

$45,000 income in a year

Equals $100

100% from wages

An Aircraft Technician

$45,000 income in a year

100% from wages

Equals $100

That’s 450 squares, which represents $45,000 in wages. So if someone makes $100,000 in a year like the sales representative below, we use one thousand squares:

A Sales Representative

$100,000 income in a year

Equals $100

100% from wages

A Sales Rep.

$100,000 income in a year

100% from wages

Equals $100

The aircraft technician and sales representative both earned all of their income from wages.

Here’s a manager who earned $300,000, but 83% of it was in wages and the remainder came from business or self-employment:

A Manager

$300,000 income in a year

Equals $100

83%

from wages

17%

business

A Manager

$100,000 income in a year

83%

from wages

17%

business

Equals $100

That’s two income sources with wages and a business. ACS provides six more classifications for a total of eight income sources:

EACH SQUARE REPRESENTS $100 OF INCOME

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

EACH SQUARE REPRESENTS $100

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

Wages are money received as an employee; business income is self-employment income from one’s own business or farm; investment income comes from interest, dividends, and rents; retirement income is from pension or retirement accounts, not including Social Security; Social Security is income from Social Security; welfare income is from public assistance programs; Supplemental Security Income (SSI) is government-funded and based on need; and the other category is for any income that doesn’t fall in the defined categories.

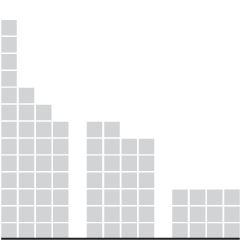

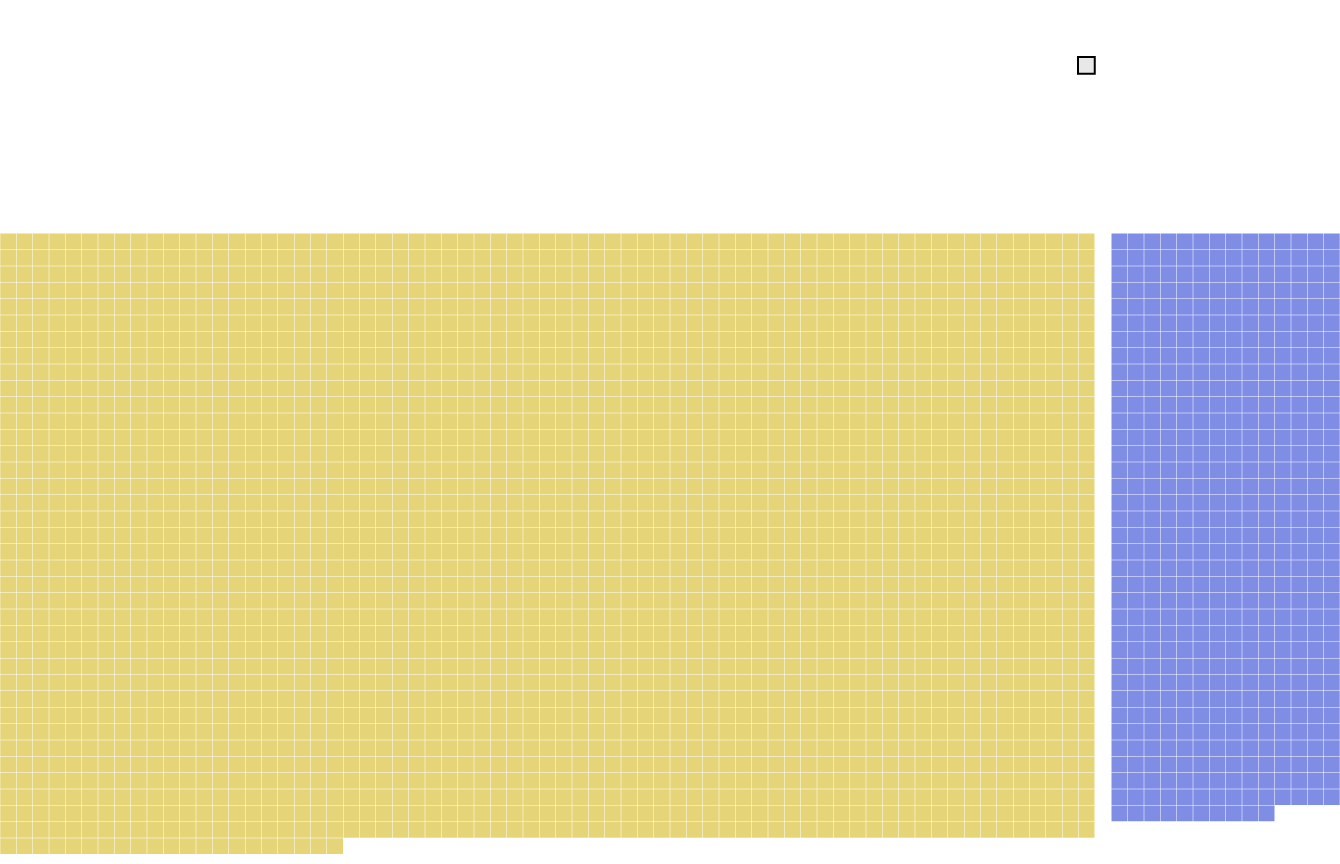

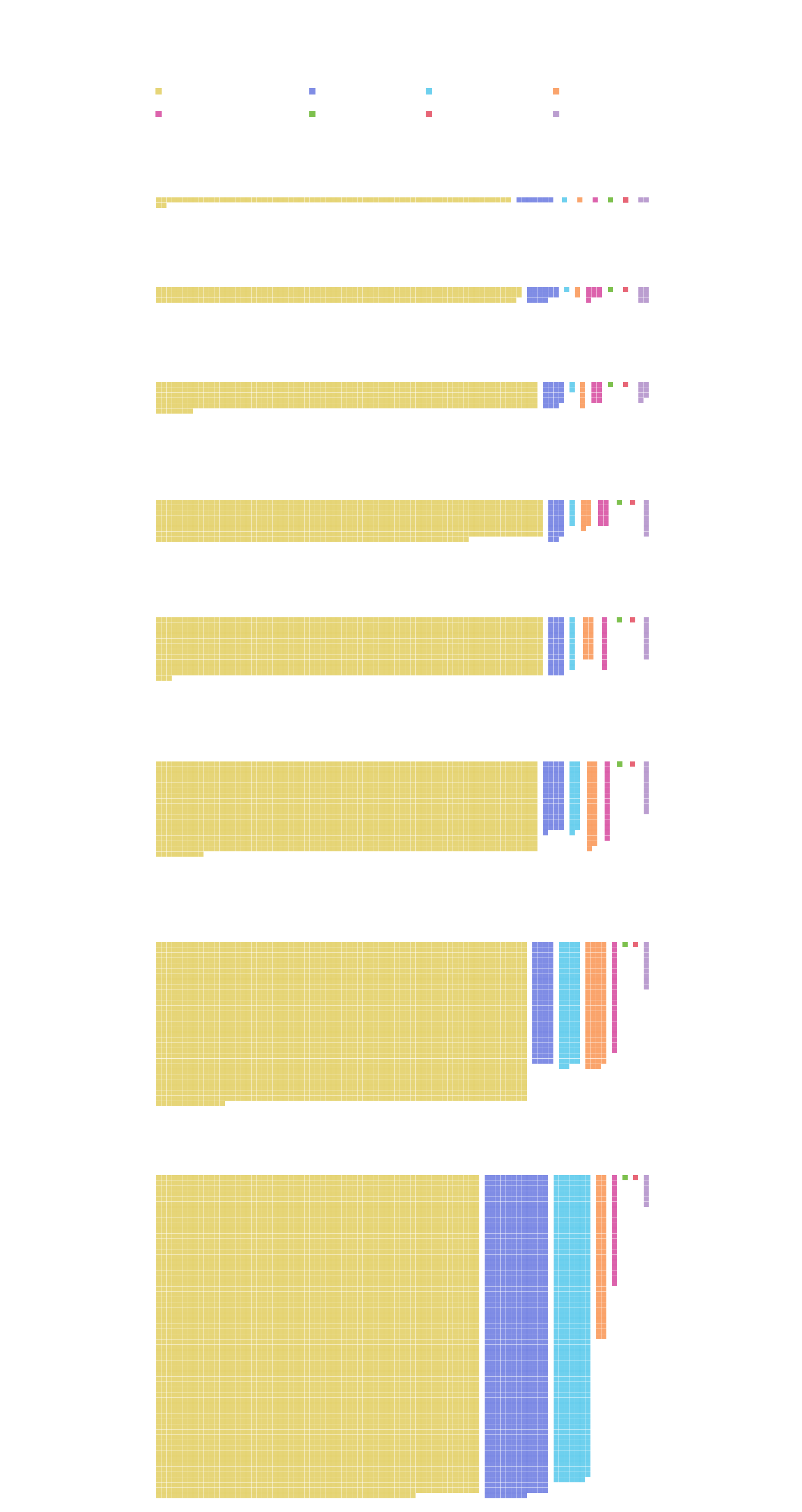

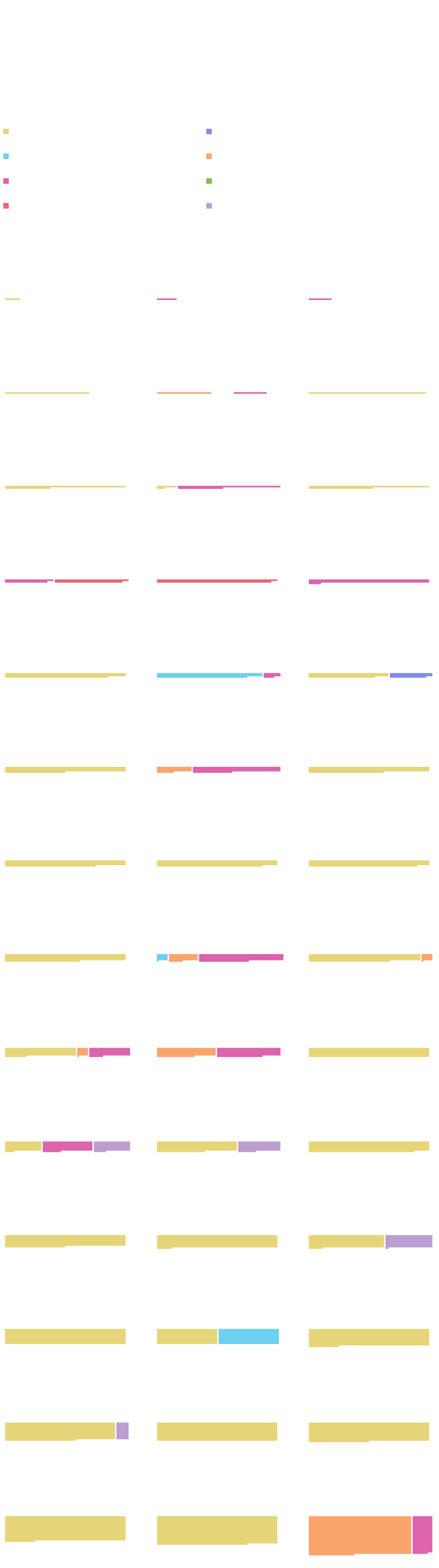

Knowing that people spend money differently when income varies, I wondered how people earn money differently. Below shows the average percentage and amount, by income group:

Income Sources On Average, By Income Group

EACH SQUARE REPRESENTS $100 OF INCOME

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

INCOME GROUP

Supplemental Security Income (SSI), a need-based program, is more common among low-income groups, as should be expected.

$0 to $14,999

83%

$15,000 to $29,999

86%

$30,000 to $49,999

90%

$50,000 to $74,999

Most people’s income comes completely from earned wages through a job.

91%

$75,000 to $99,999

91%

$100,000 to $199,999

With higher income, it grows more common to earn money in other categories besides wages, such as a personal business or investments.

90%

$200,000 to $299,999

87%

$300,000+

Those with the highest incomes tend to have high wages, but on average, about a quarter of income comes from elsewhere.

75%

15%

9%

Income Sources On Average, By Income Group

EACH SQUARE REPRESENTS $100 OF INCOME

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

Supplemental Security Income (SSI), a need-based program, is more common among low-income groups, as should be expected.

INCOME GROUP

$0 to $14,999

83% from wages

$15,000 to $29,999

86%

$30,000 to $49,999

90%

Most people’s income comes completely from earned wages through a job.

$50,000 to $74,999

91%

$75,000 to $99,999

91%

With higher income, it grows more common to earn money in other categories besides wages, such as a personal business or investments.

$100,000 to $199,999

90%

$200,000 to $299,999

87%

Those with the highest incomes tend to have high wages, but on average, about a quarter of income comes from elsewhere.

$300,000+

75%

15%

9%

People who make the big bucks appear to be more likely to earn income from their own business and investments, in addition to an employee salary.

But keep in mind that the above shows averages. If you take the average of a person who makes all their income from a business and a person who makes all their money from a salary, then the average looks like a half-half split between business and salary. It’s probably more likely that someone either earns income from a salary or a business and that gets supplemented by investments.

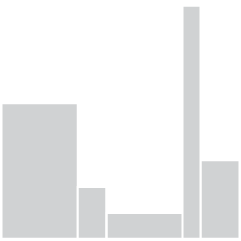

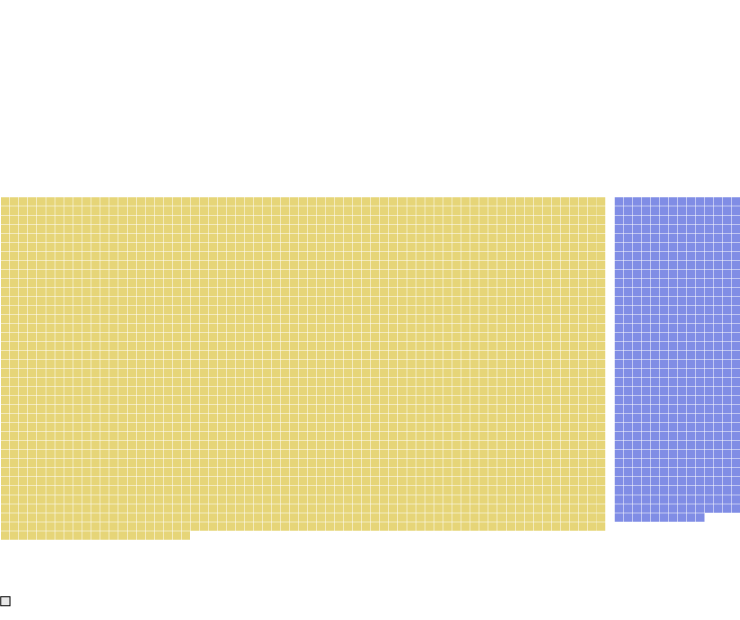

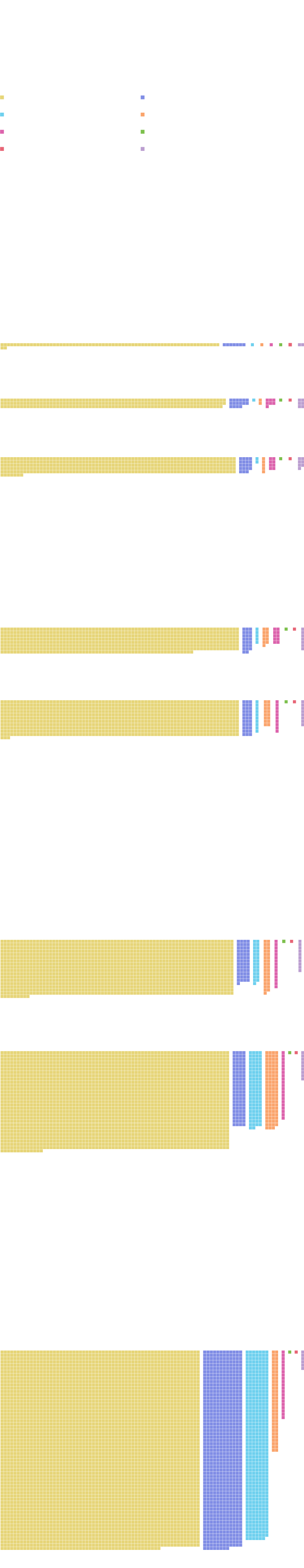

You can kind of see this in a sample of individuals’ incomes:

Income Sources for Different People

EACH SQUARE REPRESENTS $100 OF INCOME

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

Housekeeper

Not working

Not working

Fast food

Stocker

Sales

$1,000

$1,300

$1,500

$1,800

$3,000

$5,000

100%

100%

100%

100%

100%

100%

Gambling svc.

Not Working

Cook

Not working

Not working

Fast food

$5,600

$5,800

$7,800

$8,400

$9,000

$10,000

100%

62%

38%

100%

100%

100%

100%

Cashier

Business operations

Cook

Not working

Not working

Not working

$11,000

$11,600

$12,300

$14,400

$15,000

$15,200

100%

16%

84%

100%

100%

100%

52%

48%

Not working

Not working

Not working

Fast food

Registered nurse

Laborer

$15,400

$15,600

$16,800

$18,800

$20,000

$20,800

39%

61%

100%

100%

11%

89%

100%

100%

Childcare

Not working

Entertainer

Stocker

Not working

Not working

$22,800

$22,900

$23,000

$23,700

$24,200

$26,800

100%

87%

13%

65%

35%

38%

62%

96%

33%

67%

Tractor operator

Not working

Production

Production manager

Technologist

Construction

$28,000

$28,000

$29,000

$30,000

$30,000

$30,000

100%

29%

71%

100%

100%

100%

100%

Maid

Janitor

Stocker

Not working

Not working

Lawyer

$30,000

$31,000

$31,200

$31,700

$31,800

$36,200

100%

100%

100%

28%

52%

21%

15%

60%

25%

100%

Billing clerk

Not working

Secretary

Registered nurse

Payroll

Accounting clerk

$37,000

$37,100

$37,900

$40,000

$41,000

$42,000

100%

23%

69%

92%

90%

85%

15%

100%

Personal care aide

Bus driver

Inspector

Customer service

Manager

Elementary teacher

$42,900

$46,000

$48,000

$50,000

$51,000

$50,000

58%

34%

48%

52%

100%

100%

100%

100%

Postsec. teacher

Maintenance

Business ops.

Maintenance

Registered nurse

Librarian

$51,200

$53,000

$55,000

$57,200

$58,000

$60,000

29%

41%

30%

66%

34%

100%

87%

13%

100%

100%

Order filler

Financial clerk

Customer service rep.

Chief executive

Not working

Lawyer

$60,000

$65,000

$65,900

$66,000

$73,200

$75,000

100%

100%

62%

38%

18%

41%

41%

60%

40%

100%

Mechanic

Sales manager

Retail supervisor

Postsecondary teacher

Medical scientist

Manager

$80,000

$80,000

$90,000

$90,000

$91,000

$93,200

100%

50%

50%

100%

78%

22%

100%

100%

Nurse practitioner

Production supervisor

Accountant

Audiologist

Not working

Not working

$93,800

$96,000

$100,000

$101,000

$102,500

$129,890

91%

100%

100%

100%

67%

23%

93%

Manager

Postsecondary teacher

Transport. manager

Property manager

Software developer

Paralegal

$130,000

$150,000

$205,200

$220,000

$310,000

$379,800

100%

100%

84%

16%

55%

45%

94%

96%

Income Sources for Different People

EACH SQUARE REPRESENTS $100

Wages

Business

Investments

Retirement

Social Security

Welfare

SSI

Other

Housekeeper

Not working

Not working

$1,000

$1,300

$1,500

100%

100%

100%

Gambling svc.

Not working

Cook

$5,600

$5,800

$7,800

100%

62%

38%

100%

Cashier

Business ops.

Cook

$11,000

$11,600

$12,300

100%

16%

84%

100%

Not working

Not working

Not working

$15,400

$15,600

$16,800

39%

61%

100%

100%

Childcare

Not working

Entertainer

$22,800

$22,900

$23,000

100%

87%

13%

65%

35%

Tractor operator

Not working

Production

$28,000

$28,000

$29,000

100%

29%

71%

100%

Maid

Janitor

Stocker

$30,000

$31,000

$31,200

100%

100%

100%

Billing clerk

Not working

Secretary

$37,000

$37,100

$37,900

100%

23%

69%

92%

Personal care

Bus driver

Inspector

$42,900

$46,000

$48,000

58%

34%

48%

52%

100%

Postsec. teacher

Maintenance

Business ops.

$51,200

$53,000

$55,000

29%

41%

30%

66%

34%

100%

Order filler

Financial clerk

Customer svc.

$60,000

$65,000

$65,900

100%

100%

62%

38%

Mechanic

Sales manager

Retail spvsr.

$80,000

$80,000

$90,000

100%

50%

50%

100%

Nurse prac.

Production spvsr.

Accountant

$93,800

$96,000

$100,000

91%

100%

100%

Manager

Postsec. teacher

Transport. manager

$130,000

$150,000

$205,200

100%

100%

84%

16%

People only list their primary occupation, so the property manager who earned $220,000 likely has another job which may or may not be related to property management.

You can probably see though that most people’s income is from wages. For those who don’t work, Social Security and retirement income come into play.

Finally, most people do not earn from investments, but those who reported non-zero investment income seem to earn a significant portion of their income in this way. Maybe we’re looking at survivorship bias? We don’t see those who invested but did not earn. However, out of those who reported non-zero investment income, only five percent reported a loss for the year, so take that information as you like. And of course those with higher salaries have more to set aside after paying for essentials.

For the other side of the coin, see how people spend their money.

Become a member. Support an independent site. Make great charts.

See What You GetFlowingData is made possible by supporting members. Since 2007, I, Nathan Yau, a real person, have been analyzing and visualizing data to help more people understand and appreciate it in their everyday lives.

If you liked this or want to make similar data things, please consider supporting this small corner of the internet. You get unlimited access to visualization courses, tutorials, and extra resources. Thanks. — Nathan