Stock Market Recovery Time, a Long-Term Perspective

Stock markets dropped in value this week, and it seems there is more turbulence ahead. So households, at least 58% of them in the United States, are seeing the value of their savings decrease significantly over a short period of time.

The S&P 500, a stock market index that tracks 500 major companies in the United States, is down 18% since the inauguration, as of April 8, 2025.

Perhaps it is helpful to examine through a long-term perspective. Use the slider in the chart above to shift point of view.

In the short-term, recent drops feel like a lot. Zoom out all the way, and you see a jagged line that drifts up and to the right.

The S&P 500 recovered after every drop.

It’s very likely the market will recover from the most recent drop. But how long will it take? When will the value line shift upwards again? This part is more uncertain.

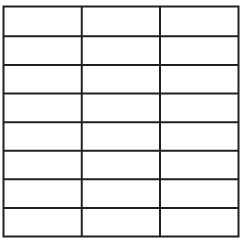

For ideas, we look at past drops and how long it took to recover. Below are the largest drops since 1957 for 5-, 10-, and 20-day trading spans.

Largest 5-Day Drops and Recovery for S&P 500

Longer-spanning drops in 1987, 2008, and more recently, during the pandemic in 2020 top the list.

| Rank | Date Range | End Value | Drop | Recovery Time |

|---|---|---|---|---|

| 1 | 1987, Oct. 12 – Oct. 19 | $224.84 | -27.3% | 557 days |

| 2 | 1987, Oct. 13 – Oct. 20 | $236.83 | -24.7% | 580 |

| 3 | 2008, Oct. 2 – Oct. 9 | $909.92 | -18.3% | 446 |

| 4 | 2008, Oct. 3 – Oct. 10 | $899.22 | -18.2% | 409 |

| 5 | 2020, March 5 – March 12 | $2,480.64 | -18.0% | 83 |

| 6 | 2008, Nov. 13 – Nov. 20 | $752.44 | -17.4% | 33 |

| 7 | 1987, Oct. 15 – Oct. 22 | $248.25 | -16.7% | 481 |

| 8 | 1987, Oct. 14 – Oct. 21 | $258.38 | -15.3% | 552 |

| 9 | 2008, Oct. 1 – Oct. 8 | $984.94 | -15.2% | 532 |

| 10 | 2020, March 13 – March 20 | $2,304.92 | -15.0% | 26 |

| 23 | 2025, April 1 – April 8 | $4,982.77 | -11.5% | ? |

The current 5-day span that includes April 8 doesn’t make the top ten, but it’s still high on the list at the 23rd biggest drop.

Largest 10-Day Drops and Recovery for S&P 500

The same years lead the way. Although the current 13.7% drop doesn’t seem so bad compared to the others. Hopefully it stays that way. Probably not.

| Date Range | End Value | Drop | Recovery Time | |

|---|---|---|---|---|

| 1 | 1987, Oct. 5 – Oct. 19 | $224.84 | -31.5% | 631 days |

| 2 | 1987, Oct. 12 – Oct. 26 | $227.67 | -26.4% | 557 |

| 3 | 2008, Sept. 26 – Oct. 10 | $899.22 | -25.9% | 574 |

| 4 | 1987, Oct. 13 – Oct. 27 | $233.19 | -18.2% | 580 |

| 5 | 1987, Oct. 6 – Oct. 20 | $236.83 | -25.8% | 591 |

| 6 | 2008, Sept. 25 – Oct. 9 | $909.92 | -24.7% | 566 |

| 7 | 1987, Oct. 14 – Oct. 28 | $233.28 | -23.6% | 552 |

| 8 | 2020, March 4 – March 18 | $2,398.10 | -23.4% | 93 |

| 9 | 2020, March 2 – March 16 | $2,386.13 | -22.8% | 93 |

| 10 | 2020, March 6 – March 20 | $2,304.92 | -22.5% | 81 |

| 41 | 2025, March 25 – April 8 | $4,982.77 | -13.7% | ? |

The 1987 and 2008 recoveries took about one and a half years, whereas the post-pandemic recovery shot back up in a few months. Maybe that’s something to grasp onto in the current situation.

Largest 20-Day Drops and Recovery for S&P 500

The 2020 drops bubble up in this wider timespan. The drops were bigger so they took longer to recover, but even so, recovery only took about half a year.

| Rank | Date Range | End Value | Drop | Recovery Time |

|---|---|---|---|---|

| 1 | 2020, Feb. 21 – March 20 | $2,304.92 | -30.9% | 167 days |

| 2 | 2020, Feb. 24 – March 23 | $2,237.40 | -30.6% | 105 |

| 3 | 1987, Sept. 28 – Oct. 26 | $227.67 | -29.6% | 613 |

| 4 | 2020, Feb. 14 – March 16 | $2,386.13 | -29.4% | 180 |

| 5 | 2020, Feb. 19 – March 18 | $2,398.10 | -29.2% | 181 |

| 6 | 2020, Feb. 20 – March 19 | $2,409.39 | -28.6% | 174 |

| 7 | 2008, Sept. 12 – Oct. 10 | $899.22 | -28.2% | 830 |

| 8 | 2008, Sept. 26 – Oct. 24 | $876.77 | -27.7% | 574 |

| 9 | 1987, Sept. 21 – Oct. 19 | $224.84 | -27.6% | 599 |

| 10 | 1987, Sept. 30 – Oct. 28 | $233.28 | -27.5% | 600 |

| 159 | 2025, March 7 – April 4 | $5,074.08 | -12.1% | ? |

I’m no financial advisor, but if you’re saving for a future that is a while from now or don’t need the funds right away, a long-term approach seems better than panic selling at dropping values.

I could also just be trying to reason my way out of the madness.

Analyze, visualize, and communicate data usefully — beyond the defaults. Become a member →