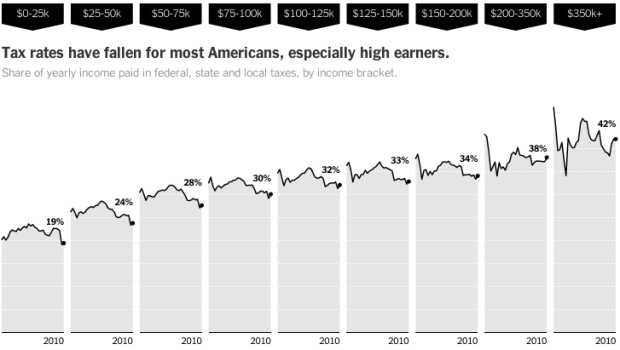

Mike Bostock, Matthew Ericson and Robert Gebeloff for the New York Times explored changing tax rates from 1980 to 2010, for various income levels.

Most Americans paid less in taxes in 2010 than people with the same inflation-adjusted incomes paid in 1980, because of cuts in federal income taxes. At lower income levels, however, much of the savings was offset by increases in federal payroll taxes, state sales taxes and local property taxes. About half of households making less than $25,000 saved nothing at all.

Instead of trying to squeeze everything into one space, the graphic reads like a story, with changes in different types of taxes and comparisons across income levels.

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

What isn’t evident and perhaps the most misleading part of the debate is income made on investments which are taxed at a much lower rate. I’d like to see tax rate versus share of GDP over time then we could have a conversation.

Actually the last graph on the NYT site sort of addresses that.

There is a major problem with this graph. $99K in 1980 would be worth approx $250K now so the same “job” would appear to move 4 bars to the right. The 1980 income tax by pay grouping brears no resemblance to that of today’s

The first line of the graphic reads:

“Most Americans paid less in taxes in 2010 than people with the same inflation-adjusted incomes paid in 1980”

Nice graph. @Eristdoof, I think they adjusted for inflation.

Awesome work. One thing I’d really like to see some additional insights. For example, to see only the years when the republican or the democrat presindent was in the White house.

Wouldn’t 1980’s tax rate be more of a legacy of Jimmy Carter than Ronald Reagan?

Reagan became president in 1980 and his administration passed major tax cuts and more notably the 1986 tax reform. 1980’s tax policy was completely dominated by Reagan initiatives, although the 1986 tax reform was drafted by the treasury department long before the Reagan administration took over.

@Mikev:

Reagan didn’t become president until January of 1981. He was elected in November of 1980. The tax rates in 1980 were Carter’s.