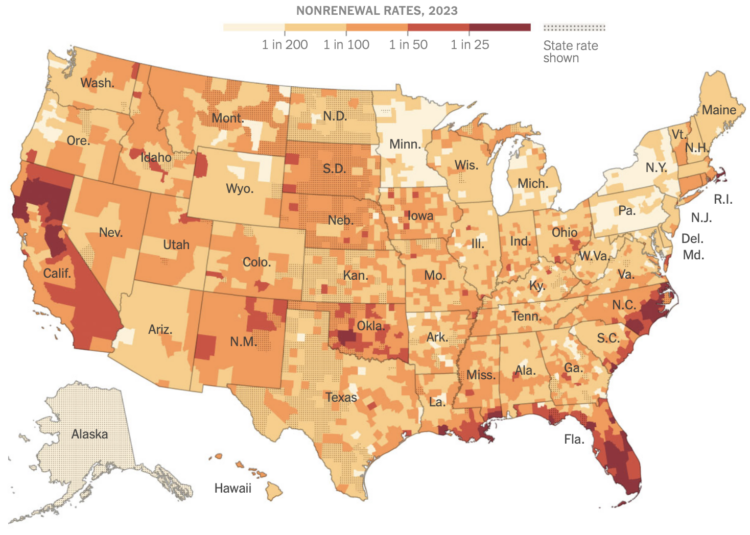

Because of a warming planet with more wildfires and hurricanes, it’s growing more common for insurance companies to stop insuring people with existing policies. For the New York Times, Christopher Flavelle, with analysis and graphics by Mira Rojanasakul, describes the coverage shift.

The consequences could be profound. Without insurance, you can’t get a mortgage; without a mortgage, most Americans can’t buy a home. Communities that are deemed too dangerous to insure face the risk of falling property values, which means less tax revenue for schools, police and other basic services. As insurers pull back, they can destabilize the communities left behind, making their decisions a predictor of the disruption to come.

Oh good.