The bill proposed by the current administration affects incomes of the poor and the rich in an unusual way. To demonstrate, for NYT’s the Upshot, Emily Badger, Alicia Parlapiano, and Margot Sanger-Katz compare the bill against previous bills.

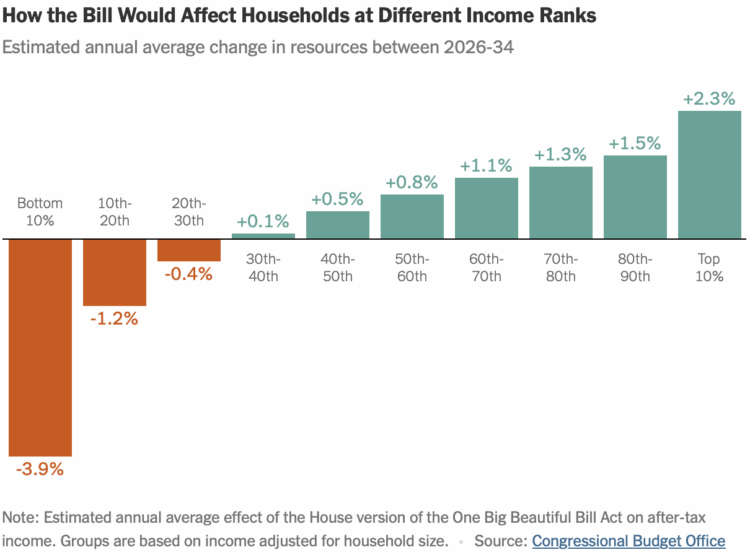

The bill as passed by the House in May would raise after-tax incomes for the highest-earning 10 percent of American households on average by 2.3 percent a year over the next decade, while lowering incomes for the poorest tenth by 3.9 percent, according to new estimates by the Congressional Budget Office.

The shape of that distribution is rare: Tax cut packages have seldom left the poor significantly worse off. And bills that cut the safety net usually haven’t also included benefits for the rich. By inverting those precedents, congressional Republicans have created a bill unlike anything Washington has produced since deficit fears began to loom large in the 1990s.