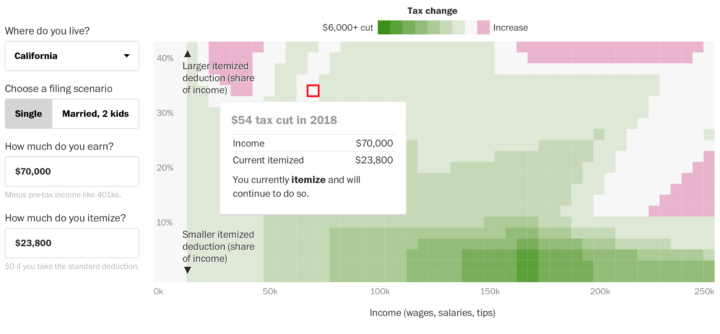

Here’s a different look at tax cuts and increases from Reuben Fischer-Baum for The Washington Post. As Fischer-Baum points out, keep in mind that these are just estimates and they calculations vary:

Analyses that use data from real taxpayers as their starting point – like the calculator put together by the New York Times – produce lower estimates. Other calculators like the one put together by the Wall Street Journal produce similar results to ours. For example, a household in D.C. filing jointly with two kids under 17, earning a total of $150,000 and itemizing $20,000 gets a tax cut of $3,796 in our analysis. Roughly equivalent inputs to the New York Times calculator produces an estimated range of a $1,020 to $3,280 cut, while the Wall Street Journal calculator – which is based on the less generous House bill – produces a cut of $3,230.