Wilson Andrews and Alicia Parlapiano report for The Washington Post on how the fight over tax breaks affects your bottom line:

Tax cuts enacted under former president George W. Bush are set to expire at year’s end, and lawmakers are battling over whether to extend them before the November elections. Most Republicans want to extend all of the cuts, saying that any increase in taxes will hold back the economic recovery. President Obama and Democratic leaders would extend many of the cuts but say tax breaks for top earners should expire to pare down deficits. Each plan would affect average tax rates for income groups differently.

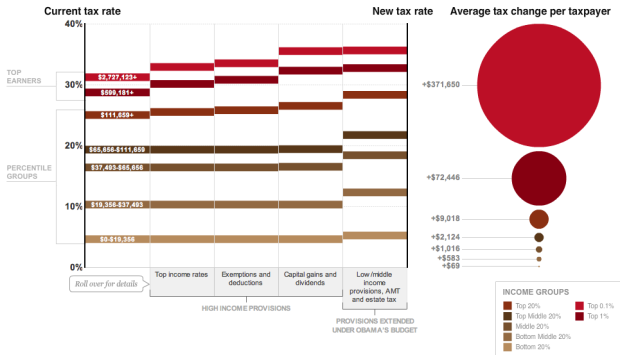

Each row represents an income group, and you can flip between letting Bush’s tax cuts expire, shifting to Obama’s plan, and extending the current cuts. Bubbles on the right show the average tax change per taxpayer for each income group. Switch from the first option (letting all cuts expire) to the second (Obama’s plan), and you’ll notice some changes for top earners.

Moving from left to right, you start with a base rate, and then provisions increase that rate with the final new rate at the end of the row. This part slightly confused me — and maybe this is because I’ve been a graduate student for the past five years and taxes have never been a major concern for me — but after some fiddling it seems to make sense.

Overall, and correct me if I’m wrong here, under Obama’s plan, taxes go down compared to if we were to just let the cuts expire and would go up, compared to Bush’s cuts.

However, if we extend cuts or implement new ones, it “costs” the government a few trillion dollars over ten years.

[via]

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

Visualize This: The FlowingData Guide to Design, Visualization, and Statistics (2nd Edition)

“Costs” is the right word only if you use the expiration of all the cuts as a baseline. Otherwise the increased “costs” all fall on the taxpayers. Looks like a bigger tax bill next year to me.

Well, who else would governmental costs fall on?

You’ve asked the wrong question John. If you have less money, you spend less. If you lose your job, you don’t run out and buy that new car. The issue here, is that the gov’t never. ever. cuts spending. the politicians (most of who have never run a business or had a real job) think that we’re a big cow, and we must be milked for our own good, because they know better than us.

Democrat? Republican? Please, they’re all the same.

“We the people” or in this case the taxpayers are “costing” the government by not paying higher taxes…hmm? This is certainly a liberal viewpoint. I prefer to look at it from the standpoint that excessive government spending is costing the taxpayer. By taking more out of the taxpayer’s pocket, the taxpayer can’t purchase and the small business owner can’t/won’t hire. Because the taxpayer population is further reduced, the government revenue “loss” is much greater. Lower taxes must be part of the overall strategy for reducing unemployment and building the economy. The concept of overtaxing the “rich” is wrong-headed. Current progressive thought patterns don’t minimize the gaps between rich and poor, then only create more poor by reducing the middle class and expanding the gap between rich and middle.

I appreciated the chart, and think it was a pretty good visual – thanks for pointing it out. Long time follower, first time commenter :) However your last line got me. I’m sure it was not meant to be glib, but after following this blog for a bit I’m fairly certain of your political leanings.

Another way of saying “a few trillion dollars over ten years” is also saying “I want to maintain the standard of living I’m accustomed to, so make it the next generation’s problem.” Every time someone says “a few trillion dollars” I get kind of upset in that yes-i-said-trillion-with-a-t kind of way. People just throw it around. T is the new B. Most folks think that, because there just three more zeros, 1 trillion is just three times 1 billion. The sense of scale is lost on people.

Here’s a FD chart for you: How about a web site with a trillion letters on it? Problem? You bet. A website with a billion letters on it (1GB) might take a person on a standard cable modem about three hours to download – of course, nobody would wait that long. However, a website with a trillion letters (1TB) would take four and a half months. (Source: http://www.numion.com/calculators/time.html). (Not to mention the memory required to edit it, but thats a side point).

I guess this is a long way of saying I feel this chart understates the long-term costs, which will are all ungodly high unless we go with Option 1. The chart says “Cost to Gov’t”, but a cost to the government is a cost to the next generation. I’m all for lower taxes, but I’m for my children’s future first. To my mind, there is nothing more selfish and rotten than to encumber your children with a debt situation like this one – one you could change, but didn’t want pay more for your nicely mowed lawn.

Short term pain is necessary – we’ve been pushing the problem off too long and our proverbial head is stuck in the sand. Bush is to blame for accelerating the problem – he started the era of reckless spending – but Obama is to blame for making it much, much worse.

To Gary Rue – Everyone has been benefiting from this debt arrangement. We’ve all had our standard of living increased through debt by the roads we drive, the schools we attend, the subsidized gasoline and groceries, the clean air and public spaces, etc.etc. This is not a rich/poor issue. Everyone needs to pay a proportional share through increased taxes – poor and rich. Nobody should be overtaxed or undertaxed. Anything else is redistribution of wealth.

(PS: This was going to be the end of my now-quite-off-topic rant but I found it curious that the spell checker for this text box says the word “overtaxed” is ok, but “undertaxed” is not. What does that say about our collective mentality :) )

@Mark – welcome to the FD comment club :).

I didn’t mean to toss around a trillion like a it was an insignificant amount of money. It’s a huge amount and shouldn’t be taken lightly. Mainly, it felt weird to me that we were costing the government, but after reading the comments, I can see how that’d make sense.

In any case, your comment reminded me of this letter from a Berkeley public policy professor I read last night. I think you’ll appreciate it:

http://blogs.berkeley.edu/2010/08/24/a-letter-to-my-students/

My apologies for misinterpreting… You caught me in a mood.

Thanks for the link.

Gary Rule said, “‘We the people’ or in this case the taxpayers are ‘costing’ the government by not paying higher taxes…hmm? This is certainly a liberal viewpoint. I prefer to look at it from the standpoint that excessive government spending is costing the taxpayer.”

It goes both ways. If you cut spending (say, by cutting Social Security benefits), you’re costing “We the people” (WtP) money, just as if you had raised their taxes (the elderly have less income). Cutting spending by $1 hurts WtP just as much as increasing taxes by $1; in both cases, WtP are worse off by $1. Similarly, increasing spending by $1 benefits WtP just as much as cutting taxes by $1; in both cases, WtP receive $1. The only difference is whether or not you “like” the people who are hurt or who benefit. I harbor no particular hostility towards those different groups of people, so I see no intrinsic reason to favor one approach over the other.

Anyway, as it applies to the tax issue, Obama’s tax cut proposal would increase the deficit by $3 trillion. That’s what people mean when they say that his tax cuts would “cost” $3 trillion. It’s the same terminology they used about the $0.8 trillion stimulus. If you say that tax cuts don’t “cost” the government, then the stimulus actually only cost about $0.5 trillion because about $270 billion of it was tax cuts. But it doesn’t matter what the terminology is: the stimulus still increased the debt by $0.8 trillion.

it’s funny how republicans said deficits don’t matter when they were throwing barrels of cash into Pentagon coffers ($300 billion disappearing in Iraq sound familiar, anyone?) and then when they’re out of power they’re all DERP DERP GOVERNMENT SPENDING BAD, GROGG NEED CUT TAXES SO GUBMINT NOT SPEND SO MUCH

Never mind that their cutting of taxes expanded the deficit because they wouldnt stop spending.

Or the fact that raising taxes would help lower the deficit

Or that these cuts for the rich are helping expand the rich/poor gap

or that the republicans are generally wrong on economics and a free market system is basically designed to destroy the little guy and keep the fat oligarchs bribing congress on top

Symbols, like the statistics they represent can be highly misleading.

The use of circle symbols to represent relative quantities in this chart can work in a different way. If the circles were to represent ALL monies collected for each category of tax payer, rather than what is collected PER taxpayer, we would see an entirely different set of circle sizes.

Also, color plays a role. Red is a color that naturally alarms people (ex: it is used for stop signs to get your attention. It is the color of blood, humans naturally are alarmed by it). In this chart, red is effective in representing someone’s notion of “the evil rich”.

The advertising world understands the psychology of the use of colors and symbols to tweak our awareness in order to sell products; likewise the Defense Mapping Agencies cartographers understand what colors and symbols to put on maps that are used in daily briefs to enhance the Commander in Chief’s understanding of current events and help shape his decisions to benefit his advisers.