Mint was released last week. It’s an online application that brings financial data from all of your credit card and bank accounts into one place. Think Quicken online and free.

Mint was released last week. It’s an online application that brings financial data from all of your credit card and bank accounts into one place. Think Quicken online and free.

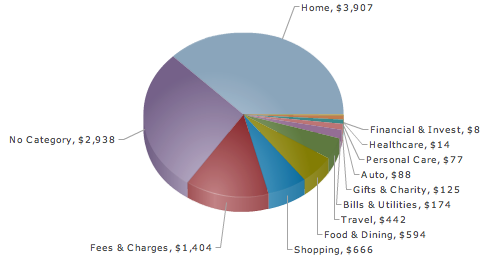

It’s super easy (only takes a few seconds) to add your financial accounts, and you only have to do it once. After you’ve added your accounts, Mint will update your data every night and compile them into useful reports. You’ll get an overview of spending trends, transactions, and even ways you can save money based on your current credit cards’ interest rates.

So far I’ve found it useful simply because all of my data is one place. As I’ve made my way into adulthood, I’ve slowly accumulated more and more credit cards to the point where it’s kind of annoying to login to every account to see how much debt I have.

One Small Annoyance

My one gripe about Mint is that the spending trends and savings features haven’t been that informative, but I imagine will get better once more data comes in and Mint continues to tweak the system. My highest hope is that they do something about the dreaded 3-d pie chart…

Overall though, I’m looking forward to seeing Mint grow and develop into an extremely useful tool that brings all of your data into one place and represents it in a way that’s understandable and interesting.

Thanks Nathan. In the months since we launched, we have signed up over 300,000 users, and the pie chart has been revamped and improved. You can also compare your spending against the others in our community and much more. Hope you are still enjoying the service!

David (VP Engineering, MInt.com)